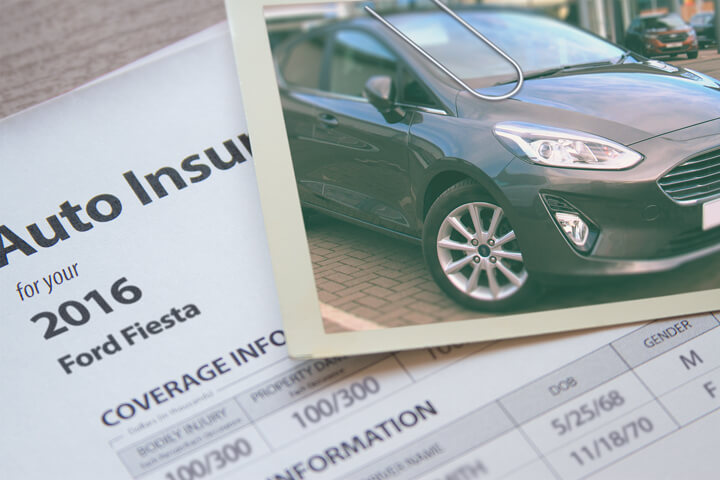

Ford Fiesta insurance policy image courtesy of QuoteInspector.com

Are you overwhelmed by the number of auto insurance companies in Sacramento? Many other drivers are too. California consumers have such a vast assortment of companies available that it can quickly become a chore to find a cheaper company. Sacramento is a wonderful place to live, but high auto insurance rates makes it difficult to make ends meet.

Are you overwhelmed by the number of auto insurance companies in Sacramento? Many other drivers are too. California consumers have such a vast assortment of companies available that it can quickly become a chore to find a cheaper company. Sacramento is a wonderful place to live, but high auto insurance rates makes it difficult to make ends meet.

We don't have to tell you that insurance companies don't want you to look at other companies. Insureds who compare rates once a year will, in all likelihood, move their business because there is a great chance of finding a lower-priced policy. A study discovered that drivers who routinely shopped around saved over $3,400 over four years compared to policyholders who never compared other company's rates.

If finding the lowest rates on Ford Fiesta insurance in Sacramento is your intention, then having some knowledge of the best ways to find and compare insurance can make the process less intimidating.

Compare Sacramento Ford Fiesta insurance quotes online

Keep in mind that having more price comparisons increases the chance that you will find more affordable insurance. Some smaller insurers do not give online Sacramento Fiesta insurance quotes, so it's important to also get quotes from them as well.

The companies shown below offer quotes in Sacramento, CA. If you want cheaper car insurance in California, it's highly recommended you get prices from several of them in order to get a fair rate comparison.

Get discounts on Sacramento insurance

Companies don't always advertise every policy discount very clearly, so we took the time to find a few of the more common and also the more inconspicuous credits available to you.

- Discount for Multiple Policies - If you can bundle your homeowners and auto insurance with one insurance company you may save approximately 10% to 15%.

- Discounts for Federal Employees - Federal government employees could qualify for a slight premium decrease with some insurance companies.

- Seat Belt Discounts - Requiring all passengers to buckle up before driving can save up to 15% off the medical payments premium.

- Safety Course Discount - Taking time to complete a course teaching driver safety skills could earn you a small percentage discount and easily pay for the cost of the class.

- Accident Forgiveness - Not a discount per se, but companies like Liberty Mutual and GEICO will turn a blind eye to one accident before hitting you with a surcharge if you are claim-free prior to being involved in the accident.

- Sacramento Homeowners Discount - Owning a house in Sacramento may trigger a policy discount on insurance because it is proof of financial responsibility.

- Renewal Discounts - A few larger companies allow discounts for renewing your policy before your current expiration date. You can save around 10% with this discount.

- Telematics Data - Insureds that choose to allow companies to spy on driving patterns by installing a telematics device such as Snapshot from Progressive or Drivewise from Allstate could save a few bucks if they are good drivers.

- Passenger Safety Discount - Vehicles equipped with air bags may get savings as much as 30%.

Don't be surprised that most credits do not apply to all coverage premiums. A few only apply to specific coverage prices like comprehensive or collision. Even though the math looks like you can get free auto insurance, companies wouldn't make money that way. Any amount of discount will definitely reduce your premiums.

Insurance companies that may offer most of the discounts above include:

If you need lower rates, check with all companies you are considering to give you their best rates. Some of the discounts discussed earlier might not be offered on policies in your state.

When to have guidance from an insurance agent

Certain consumers would rather buy from a licensed agent. An additional benefit of getting online price quotes is you may find the best rates and still have an agent to talk to.

After completing this form (opens in new window), the quote information gets sent to participating agents in Sacramento that can provide free Sacramento auto insurance quotes for your car insurance coverage. It's much easier because you don't need to do any legwork since rate quotes are delivered immediately to your email address. You can get cheaper car insurance rates without a big time investment. If you wish to quote rates from a specific car insurance provider, you would need to go to their quote page and give them your coverage information.

After completing this form (opens in new window), the quote information gets sent to participating agents in Sacramento that can provide free Sacramento auto insurance quotes for your car insurance coverage. It's much easier because you don't need to do any legwork since rate quotes are delivered immediately to your email address. You can get cheaper car insurance rates without a big time investment. If you wish to quote rates from a specific car insurance provider, you would need to go to their quote page and give them your coverage information.

Picking a provider should depend on more than just the bottom line cost. These questions are important to ask:

- Are claims handled at the agent's location?

- Are they able to provide referrals?

- How many companies do they write for?

- Does the quote include credit and driving reports?

- Does the agent have professional designations like CIC, CPCU or AIC?

- Do you qualify for any additional discounts?

- How often do they review policy coverages?

If you want a local insurance agency, it's helpful to know the different types of agencies and how they can quote your rates. Sacramento agents can be categorized as either independent (non-exclusive) or exclusive.

Exclusive Car Insurance Agencies

Agents that choose to be exclusive are contracted to one company and some examples include Allstate, Farmers Insurance, State Farm, and AAA. They usually cannot provide prices from multiple companies so they really need to provide good service. These agents are well schooled in insurance sales which helps them sell insurance even at higher premiums. Many people choose to use a exclusive agent primarily because of the brand legacy and strong financial ratings.

The following are exclusive insurance agencies in Sacramento who may provide you with rate quotes.

- Ron Andre - State Farm Insurance Agent

394 Florin Rd - Sacramento, CA 95831 - (916) 428-2918 - View Map - Travis Beyer - State Farm Insurance Agent

2455 Jefferson Blvd #115 - West Sacramento, CA 95691 - (916) 375-0144 - View Map - Monique Ambers - State Farm Insurance Agent

4331 Truxel Rd Ste G3 - Sacramento, CA 95834 - (916) 928-4747 - View Map

Independent Insurance Agents

Independent agents often have many company appointments and that gives them the ability to insure with lots of companies and get you the best rates possible. If your premiums go up, your agent can just switch to a different company which makes it simple for you.

When comparing car insurance rates, we recommend you get insurance quotes from independent agents to have the best price comparison. Most have the option of insuring with additional companies that you may not be familiar with that can offer cheaper rates than bigger companies.

Listed below is a list of independent agents in Sacramento that can give you comparison quotes.

- Nationwide Insurance: Greg Comia Insurance Agency Inc

7500 Elsie Ave Ste 106 - Sacramento, CA 95828 - (916) 682-6053 - View Map - Nationwide Insurance: Wellco Insurance Agency Inc

6905 Stockton Blvd Ste 230 - Sacramento, CA 95823 - (916) 399-8113 - View Map - Peter S Schiro Ins Agcy Inc

1515 30th St #200 - Sacramento, CA 95816 - (916) 444-9787 - View Map

Ford Fiesta Insurance Prices Can Be Cheaper

It's important that you understand some of the things that help determine your policy premiums. If you have a feel for what controls the rates you pay, this empowers consumers to make smart changes that could help you find lower car insurance prices. Lots of things are used when quoting car insurance. Some factors are common sense such as traffic violations, although others are less obvious such as your credit history and annual miles driven.

Vehicles with better crash test results means lower prices - Vehicles with good safety scores tend to be cheaper to insure. Safe vehicles reduce injuries and fewer serious injuries translates into savings for insurance companies and more competitive rates for policyholders.

Keep insurance claims to a minimum - Car insurance companies in California award discounts to people who only file infrequent claims. If you are the type of insured that files lots of claims you can definitely plan on either higher rates or even cancellation. Insurance coverage is intended for more catastrophic claims.

Getting married can save you money - Having a significant other may earn you lower rates when shopping for car insurance. Having a spouse is viewed as being more responsible and statistics show married drivers tend to file fewer claims.

How much liability - A critical coverage on your policy, liability insurance will afford coverage if ever you are responsible for causing personal injury or damage in an accident. Liability provides you with a defense in court starting from day one. It is affordable coverage as compared to coverage for physical damage, so do not skimp.

Loss probability for a Ford Fiesta - Companies analyze claim trends for every vehicle when they file their rates in each state. Vehicles that statistically have higher loss trends will have a higher cost to insure. The next table illustrates the loss history for Ford Fiesta vehicles.

For each coverage type, the loss probability for all vehicles, as an average, is set at 100. Numbers shown that are under 100 represent a good loss history, while numbers above 100 point to more claims or larger claims.

| Specific Ford Model | Collision | Property Damage | Comp | Personal Injury | Medical Payment | Bodily Injury |

|---|---|---|---|---|---|---|

| Ford Fiesta | 96 | 91 | 73 | 115 | 123 | 113 |

Statistics Source: Insurance Institute for Highway Safety for 2013-2015 Model Years

Three main reasons to buy car insurance

Despite the high cost of buying insurance for a Ford Fiesta in Sacramento, paying for car insurance is mandatory in California but it also protects more than you think.

First, just about all states have compulsory liability insurance requirements which means it is punishable by state law to not carry a minimum amount of liability insurance coverage if you want to drive legally. In California these limits are 15/30/5 which means you must have $15,000 of bodily injury coverage per person, $30,000 of bodily injury coverage per accident, and $5,000 of property damage coverage.

Second, if your Ford Fiesta has a lienholder, most lenders will make it mandatory that you have physical damage coverage to ensure the loan is repaid in case of a total loss. If the policy lapses, the bank may insure your Ford for a much higher rate and force you to reimburse them a much higher amount than you were paying before.

Third, insurance protects both your Ford Fiesta and your assets. Insurance will also pay for most medical and hospital costs for not only you but also any passengers injured in an accident. Liability coverage, the one required by state law, also pays for attorney fees and expenses if someone files suit against you as the result of an accident. If your Ford gets damaged, comprehensive and collision coverage will pay to repair the damage.

The benefits of insuring your Fiesta more than offset the price you pay, especially with large liability claims. According to a survey of 1,000 drivers, the average driver is overpaying over $865 each year so we recommend shopping around at every policy renewal to save money.

Do the work, save more money

More affordable car insurance in Sacramento can be purchased both online as well as from insurance agents, so you need to quote Sacramento auto insurance with both to get a complete price analysis. Some insurance companies do not provide online rate quotes and these regional carriers provide coverage only through local independent agencies.

When you buy Sacramento auto insurance online, you should never skimp on critical coverages to save a buck or two. In many instances, someone dropped full coverage only to find out that it was a big error on their part. Your objective should be to get the best coverage possible at an affordable rate but still have enough coverage for asset protection.

We just presented quite a bit of information on how to lower your Ford Fiesta insurance rates in Sacramento. It's most important to understand that the more quotes you get, the better chance you'll have of finding inexpensive Sacramento auto insurance quotes. You may even find the lowest rates come from a company that doesn't do a lot of advertising.

Steps to finding better rates for Ford Fiesta insurance in Sacramento

If your goal is the lowest price, then the best way to get more affordable car insurance rates in Sacramento is to regularly compare quotes from insurance carriers in California. You can compare prices by completing these steps.

- Spend some time learning about how auto insurance works and the changes you can make to lower rates. Many policy risk factors that cause high rates like inattentive driving and a low credit score can be amended by paying attention to minor details.

- Quote rates from exclusive agents, independent agents, and direct providers. Exclusive and direct companies can give quotes from a single company like Progressive or Allstate, while independent agencies can give you price quotes for many different companies. Find a Sacramento insurance agent

- Compare the new rates to your existing rates and see if you can save money. If you can save money and switch companies, make sure there is no lapse between the expiration of your current policy and the new one.

- Give notification to your agent or company of your intention to cancel your current car insurance policy. Submit payment along with a signed and completed policy application for your new coverage. As soon as you can, place the new proof of insurance paperwork in an easily accessible location in your vehicle.

The key thing to remember is to make sure you enter the same amount of coverage on each quote request and and to get price estimates from as many carriers as you can. Doing this ensures a fair price comparison and a thorough selection of prices.